Fear and Greed Index

Now: 12 (Extreme Fear)

Yesterday: 12 (Extreme Fear)

Last week: 14 (Extreme Fear)

Last month: 6 (Extreme Fear)

Historical index chart

select the date you want from the chart with the mouse

What does it mean

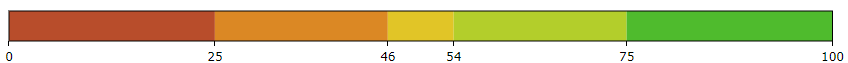

The Fear and Greed Index chart you provided uses different ranges to indicate various levels of market sentiment. Here's a detailed explanation of these ranges and their meanings:

- 0 - 25 (Extreme Fear): Color: Dark Red to Red Meaning: This range indicates extreme fear in the market. Investors are very cautious, and there is a high level of uncertainty and risk aversion. Market sentiment is very negative, and prices may be falling or highly volatile.

- 26 - 46 (Fear): Color: Orange to Yellow-Orange Meaning: This range signifies a general sense of fear among investors, but not as severe as extreme fear. The market sentiment is still negative, but there is less panic. Prices may be under pressure but not in a state of free fall.

- 47 - 54 (Neutral): Color: Yellow Meaning: This middle range indicates a balanced market sentiment. Investors are neither overly fearful nor greedy. The market is in a state of equilibrium, and prices may be stable or moving within a narrow range.

- 55 - 75 (Greed): Color: Light Green to Green Meaning: This range reflects a sense of greed among investors. Market sentiment is positive, and investors are more willing to take risks. Prices are likely to be rising, and there may be a general sense of optimism in the market.

- 76 - 100 (Extreme Greed): Color: Dark Green Meaning: This range signifies extreme greed in the market. Investors are very confident, perhaps overly so, and are taking on significant risk. Market sentiment is very positive, and prices may be reaching new highs, but there is also a risk of a market bubble. These ranges help investors understand the prevailing sentiment in the cryptocurrency market and make more informed decisions based on the level of fear or greed present. The color gradient from dark red to dark green provides a visual representation of these sentiment levels, making it easier to quickly gauge the market's mood.

How it is calculated?

The Fear and Greed Index for cryptocurrencies is a measure designed to gauge the sentiment of the crypto market. It ranges from 0 to 100, with 0 indicating extreme fear and 100 indicating extreme greed. The chart you've uploaded visualizes this index, typically represented by a gradient color scale from red (extreme fear) to green (extreme greed).

Here is an explanation of how the Fear and Greed Index is calculated:

- Volatility (25%): This measures the current volatility of the market and compares it to the average volatility over the last 30 and 90 days. An unusual rise in volatility is a sign of a fearful market.

- Market Momentum/Volume (25%): This measures the current market volume and compares it with the average of the last 30 and 90 days. Higher buying volumes in a positive market indicate a greedy market.

- Social Media (15%): This part analyzes the social media sentiment, such as the number of mentions and the interaction rate of specific hashtags related to cryptocurrencies, mainly on platforms like Twitter. An unusually high interaction rate indicates a growing public interest or a greedy market.

- Surveys (15%): Sentiment surveys involving investors, asking them how they feel about the market. The data from these surveys provide insights into the sentiment of individual investors.

- Dominance (10%): This looks at the dominance of Bitcoin (the most significant cryptocurrency by market cap) relative to the rest of the market. A rise in Bitcoin's dominance can indicate fear (as investors move to a safer cryptocurrency), while a fall can indicate greed (as investors diversify into riskier assets).

- Trends (10%): This is derived from Google Trends data for various Bitcoin-related search queries. Increasing search volumes for terms like "Bitcoin price manipulation" might indicate fear, while higher volumes for "buy Bitcoin" could signal greed.